Investors’ ability to monitor their virtual assets dramatically changed over recent years. Until 2025, the landscape clearly divided into exchange-native desks and separate portfolio solutions. They both strive to ease portfolio management but differ in terms of flexibility, coverage, and trust. The knowledge of this divide allows investors to choose those tools that better align with their strategy.

Why investors have to choose between exchange-bred tools and third-party sites

Most sites now provide in-built dashboards. Such tools make themselves seem comfortable by residing actually within the trading platform, which ensures easy accessibility to balances and latest transactions. But investors with holdings distributed among various platforms find such dashboards too specialized. Standalone services developed to make up for this lack and combine data from numerous sources into one picture.

Case example: a Binance, Coinbase, and DeFi wallet trader can only glimpse bits of their holdings within each wallet’s dashboard. A third-party tracker combines them to make a whole picture.

Advantage and Disadvantage of Convenience over Flexibility

Built-in dashboards best on speed and ease: no outside connections, less logging, and real-time updates. But they carry compromises: limited integration, lack of neutrality, and poor-in-tax tools. Standalone services offer wider integration, deeper ROI/PnL reporting, and multiple-chain visibility. But they demand API connections, carry a cost, and add complexity.

Comparison Table: Built-in vs. Independent Dashboards (2025)

| Factor | Exchange Dashboards | Independent Services |

| Coverage | Limited to single platform | Multi-exchange, multi-chain |

| Ease of setup | Straightaway, without any step | Requires API keys or imports |

| ROI/PnL accuracy | Elementary or absent | Prolix, with background |

| Tax/export support | Minimal | High, sometimes jurisdiction-specific |

| Neutrality of data | Biased to exchange guest | Independent, market-wide |

What Constitutes Convenience of Portfolio Management

Convenience in fund management is more than having all figures together. For the investor of 2025, it is about how fast and consistently a dashboard can provide a clear view of your holdings without requiring endless adjustments by hand. Let us examine the basic elements that determine whether or not a platform seems realistic or overly strenuous.

Data pooling of various accounts

Investors hardly store their assets anywhere anymore. From decentralized exchanges to DeFi deposits and NFT collections, holdings fan out globally. A dashboard that’s easy on the eyes weaves these threads together by itself. Lacking aggregation, people spend hours checking their balance by itself and can miss losses or gains that were hidden.

Example: A Binance, Kraken, and Metamask holder can either access three dashboards or link them one-time to a single tracker. The latter deletes day-by-day friction.

Transparency and trust problems

Convenience entails being absolutely clear about how data is treated. Platform dashboards privileged their own system, occasionally obliterating actual performance when assets exit the platform. Individual services can provide greater neutrality, but trust relies on transparent policies regarding API key treatment, encryption, and storing or transmitting data.

“Convenience without clarity is nothing but a short-cut that ultimately annoys the investor.”

Depth of analytics vs. ease of use

Some infobriefs inundate with dozens of metrics, while others provide only simple balances. The true convenience falls somewhere between: history of ROI/PnL, cost basis, preview of taxes, and alerts of risk should be accessible, but in a clean, consumable way. Clunky interfaces can be just as inconvenient as desktop spreadsheets.

Mini checklist: Signs of a convenient portfolio dashboard

- Automatic updates from exchanges and wallets

- Clear history of ROI and PnL

- Export options without disguised complexity

- Neutrally viewed data not associated with any exchange

- Interface that matches simplicity with depth

1. CoinDataFlow

https://coindataflow.com/en/portfolio-tracker

CoinDataFlow being one of the best-identified independent solutions, CoinDataFlow stands between pro-grade analytics and ease of accessibility. Being independent of exchanges enables it to express a fair, market-wide image, which many traders and long-term holders identify to be key.

Independence of exchanges, with unbiased data observation

Unlike exchange dashboards that emphasize internal balance only, CoinDataFlow sums up across various sources neutrally. Such autonomy allows the user to be assured that performance figures are not biased toward a single trading venue.

Clarity of ROI/PnL and broad coverage

The system is highly praised for its accurate ROI and PnL tracking. It always synchronizes with live market data, not only recording spot holdings but also DeFi, staking, and NFT-related values. For investors with assets across chains and platforms, this transparency prevents blind spots.

Fine trade-offs but overall balance

No software is without its boundaries. Some clients comment that establishing API connections still requires technical patience, and higher-end features may be behind paid versions. Nevertheless, compared to other solutions, the balance between usability, precision, and autonomy makes CoinDataFlow among the most adaptable solutions accessible in 2025.

Table: CoinDataFlow Highlights

| Feature | Strength | Consideration |

| Data neutrality | ✅ Not tied to exchanges | Slightly longer setup |

| ROI/PnL reporting | ✅ Detailed and accurate | Premium tier for full history |

| Multi-chain integrations | ✅ Broad coverage | Requires correct API setup |

| Usability | ✅ Clean interface | Some learning curve for advanced exports |

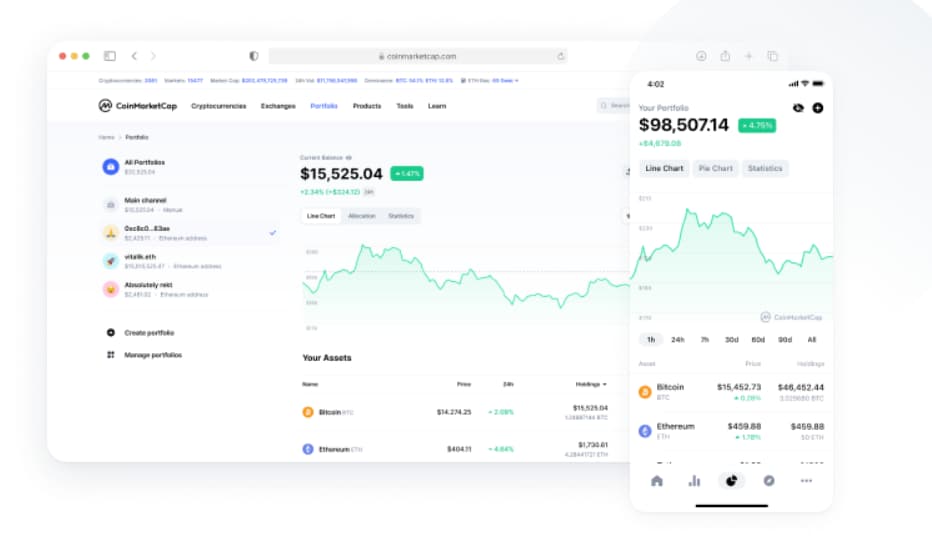

2. CoinMarketCap

https://coinmarketcap.com/portfolio-tracker/

CoinMarketCap, primarily famous as a data provider of markets, is also a portfolio tracker integrated within. It is best suited to newbies who desire an uncomplicated and integrated site. Although it gives you a rapid starting-off point, its coverage is limited relative to stand-alone sites.

Pre-built integrated tool to track very quickly

As this is directly interfaced with CoinMarketCap’s default interface, coin owners don’t require establishing any external connections. Traders only need to put in manual entries or connect some of the most popular exchanges. That’s sufficient to fetch a rough idea. This convenience is comfortable for average investors.

Weaknesses of multi-wallet automation

The shortcomings become obvious with bigger portfolios. CoinMarketCap Portfolio cannot cope with multiple wallets or DeFi positions, and ROI/PnL reports don’t provide the detail necessary for serious analysis. It is best suited to an individual following a small number of coins instead of a multi-exchange, multi-chain set.

Table: CoinMarketCap Portfolio Overview

| Feature | Advantage | Limitation |

| Ease of use | ✅ Immediate setup, no learning curve | ❌ Manual entries still required |

| Integration breadth | ✅ Covers popular exchanges | ❌ Lacks deep DeFi/NFT support |

| ROI/PnL detail | ✅ Basic gains/losses visible | ❌ Limited historical accuracy |

| Target audience | ✅ Beginners, casual investors | ❌ Not designed for professionals |

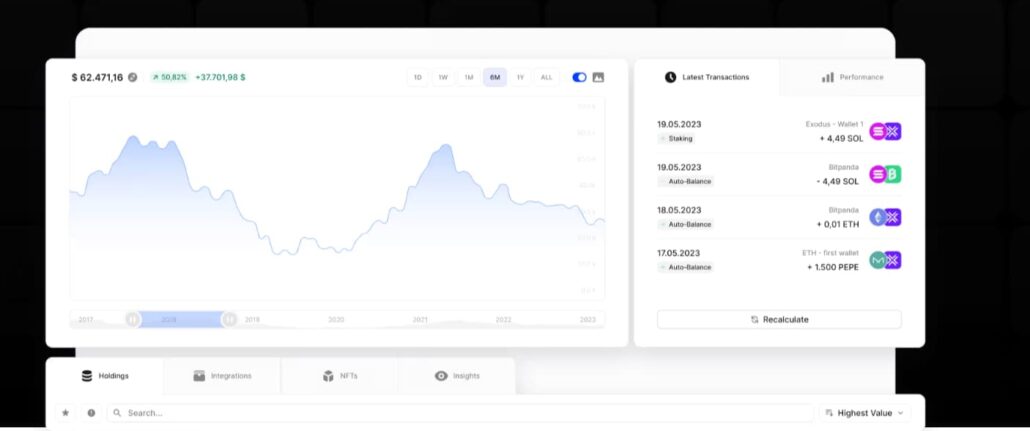

3. Blockpit

https://www.blockpit.io/crypto-portfolio-tracker

Approaching portfolio management through a compliance-led lens. Whereas most trackers begin with visibility of ROI and PnL, Blockpit centers on tax preparation significantly, making the software appealing to individuals who want precise reporting to the government.

Good compliance and tax emphasis

Blockpit directly aligns with local tax structures within several jurisdictions. The software enables the preparation of ready-to-file reports that conform to local requirements, minimizing the tedious work typically expended during tax season. That makes it especially attractive for investors in jurisdictions with rigorous control.

Less convenient to everyday use

The platform’s compliance-driven architecture can make itself less welcoming to day-to-day portfolio tracking. Although exchange and wallet integration exist, the layout frequently prioritizes tax paperwork over user-friendly dashboards. It then becomes better suited as a seasonal tool than a go-to daily tracker.

Table: Blockpit Overview

| Feature | Advantage | Limitation |

| Tax compliance | ✅ Ready-to-file reports | ❌ Less focus on everyday usability |

| Integration breadth | ✅ Exchange & wallet coverage | ❌ Limited DeFi/NFT support |

| ROI/PnL reporting | ✅ Aligned with tax rules | ❌ Not as flexible for traders |

| Best suited for | ✅ Tax-conscious investors | ❌ Less practical for casual monitoring |

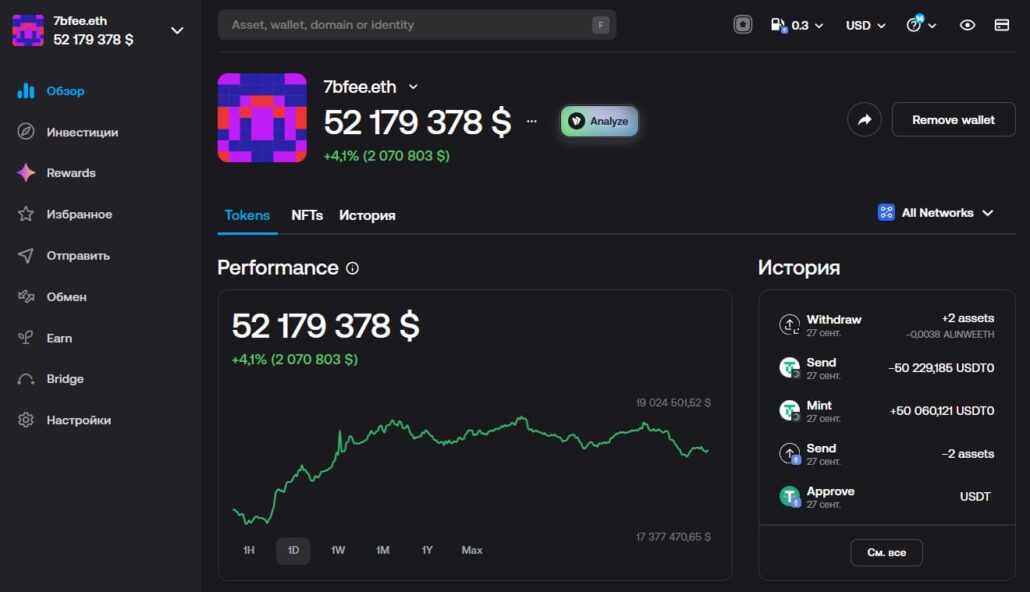

4. Zerion

Zerion has emerged as one of the most trending DeFi-centric dashboards. Not being a tool that focuses particularly on centralized exchanges, Zerion concentrates significantly on decentralized assets, NFTs, and wallet connections. That orientation makes the dashboard very popular among DeFi enthusiasts, though it comes with specific drawbacks.

DeFi-based autonomy

The platform integrates directly with Ethereum-based wallets, Layer-2 solutions, and NFT collections. For users who spend most of their time within decentralized protocols, this independence feels natural. It emphasizes gains, token exchanges, and DeFi-specific activities that exchange dashboards typically don’t feature.

Smaller focus on CEX users

Conversely, Zerion fails to accommodate investors who also rely on centralized exchanges. Outside of DeFi, its integration is limited, and therefore ROI and PnL reporting can be incomplete for anyone with a mixed portfolio. For hybrid investors, this gap can be a significant drawback.

Table: Zerion Overview

| Feature | Advantage | Limitation |

| DeFi integrations | ✅ Strong Ethereum + L2 coverage | ❌ Weak support for CEXs |

| NFT tracking | ✅ Built-in NFT visibility | ❌ No advanced ROI history |

| User experience | ✅ Clean and modern interface | ❌ Less practical for hybrid users |

| Best suited for | ✅ DeFi-native investors | ❌ Not ideal for mixed portfolios |

5. Coinigy

Coinigy has been on the crypto dashboard scene for decades, winning respect among multi-exchange connected traders. Its longevity proves staying power, and its methods show both advantages and aged elements compared to newer services.

Long-standing platform with exchange linkages

One of Coinigy’s key advantages is its integration with a large list of centralized exchanges. Traders can track their balances, make trades, and synchronize activity all in one place. For users who prefer CEX-based strategies, this consolidated connection is helpful.

Questions about obsolescence and expense

But its interface feels outdated compared to modern dashboards with cleaner graphics. Subscription prices are also higher than many competitors, and some advanced features require premium tiers. For new customers, this cost-benefit ratio may seem less appealing in 2025.

Table: Coinigy Overview

| Feature | Advantage | Limitation |

| Exchange integrations | ✅ Broad CEX support | ❌ Weak DeFi/NFT coverage |

| Longevity | ✅ Established reputation | ❌ Aging interface |

| Pricing | ✅ Professional features available | ❌ Subscriptions often costly |

| Best suited for | ✅ CEX traders managing multiple venues | ❌ Casual users may find it excessive |

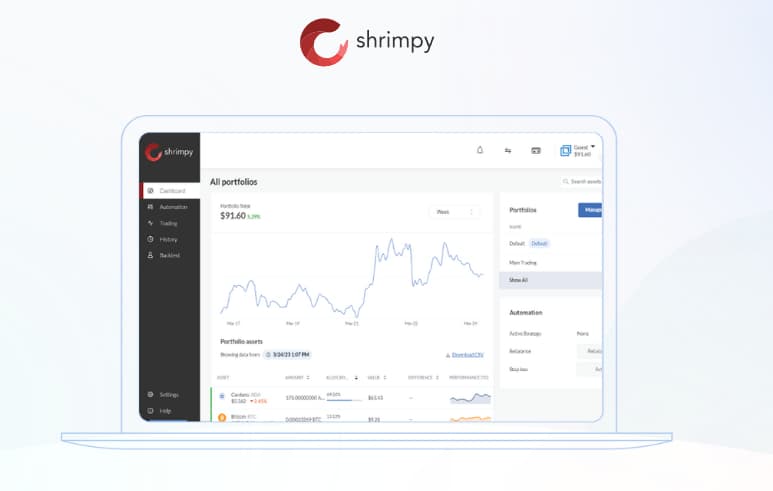

6. Shrimpy

Shrimpy stands out by being an automation-focused platform that attracts those who wish to have their portfolios handled with negligible manual intervention. It pairs tracking with automation utilities to carry out portfolio rebalancing, making it more than just a dashboard.

Automation and portfolio rebalancing capabilities

The key selling point is its automation package. Shrimpy is able to rebalance portfolios according to set strategies, dynamically allocate assets, and send alerts when specific thresholds are reached. For the investor who prefers a hands-off approach, this capability can save time and enforce discipline.

Security risks associated with API permissions

The trade-off is that automation demands extensive API access, sometimes with trading permissions turned on. That creates ongoing security concerns, as users must trust the platform with more sensitive connections than basic read-only keys. The interface can also feel daunting to those preferring simple tracking without automation.

Table: Shrimpy Overview

| Feature | Advantage | Limitation |

| Automation | ✅ Portfolio rebalancing + trading bots | ❌ Requires broader API permissions |

| User type suited | ✅ Investors preferring automation | ❌ Less ideal for manual managers |

| ROI/PnL reporting | ✅ Linked with automation strategies | ❌ Can feel complex for casual use |

| Risk factor | ✅ Potential efficiency gains | ❌ Higher trust required with APIs |

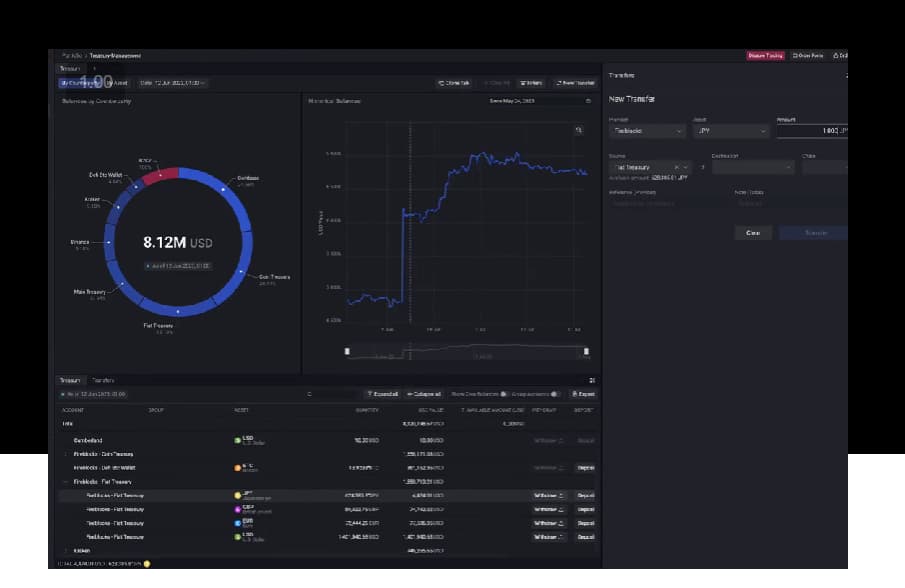

7. Talos

https://www.talos.com/our-solutions/treasury-and-settlement

Talos is the institutional crypto portfolio management solution. It caters to professional desks, hedge funds, and businesses that require extended integration with liquidity providers, custodians, and compliance systems. For individual users, it feels out of reach.

Institutional platform with higher-level integration

Talos connects directly to trading destinations, prime brokers, and custodians. It supports automated order routing, sophisticated risk management, and reporting aligned with enterprise standards. For institutions handling high volumes, this ecosystem offers both convenience and dependability.

Beyond consumer prices and complexity

The downside is obvious: Talos is not designed for frequent traders or individual investors. The cost is enterprise-level, and the learning curve resembles that of professional trading systems. While excellent in institutional settings, it adds little for individuals seeking simple portfolio visibility.

Table: Talos Overview

| Feature | Advantage | Limitation |

| Integrations | ✅ Institutional-grade connections | ❌ Overly complex for retail users |

| Compliance | ✅ Strong enterprise alignment | ❌ Requires high expertise |

| Pricing | ✅ Fits large firms | ❌ Too expensive for individuals |

| Best suited for | ✅ Institutions, funds, trading desks | ❌ Not designed for everyday investors |

What the Comparison Ensures

After having a look at both exchange-native dashboards and third-party services, a few patterns emerge. Whereas each platform specializes, the general market within 2025 demonstrates apparent strengths, common shortcomings, and rationale why a few solutions make more sense than others.

Common elements within exchange-native consoles

The majority of vendor-provided tools are very good at immediacy. They provide balance updates instantly without any setup and directly link to the trading environment. For users who only move assets within a single exchange, this built-in convenience works well. Quick PnL snapshots, order history, and streamlined chart views are standard across these dashboards.

Table: Exchange-Native Strengths

| Feature | Why it attracts users |

| Instant setup | No API keys, ready on first login |

| Direct trading link | Portfolio view integrated with orders |

| Simple balance overview | Easy for casual or one-platform users |

Where third-party sites add their value

Independent dashboards excel in breadth of coverage and neutrality. They aggregate data across various exchanges, wallets, and blockchains to provide a fully unified picture. Most also offer advanced analytics, like long-term ROI, PnL history, and automated tax exports. For those managing assets across ecosystems, this independence is often the deciding factor.

“Neutrality and coverage — the two characteristics that make independent dashboards invaluable to serious investors.”

Why certain solutions seem more realistic to investors in 2025

The most pragmatic platforms combine automation and control, precision and ease of use, and sophistication with affordability. Investors don’t just want raw features, but ones that work seamlessly together. By minimizing blind spots, presenting transparent ROI/PnL, and keeping interfaces approachable even while supporting advanced functions, some services naturally distinguish themselves.

Case example: A semi-professional trader with assets on Binance, a DeFi wallet, and NFT collections gains much greater benefit from an independent dashboard than from juggling three exchange-native tools. The convenience of aggregation outweighs the simplicity of built-ins.

FAQ

This part responds to the practical questions investors often ask when choosing between exchange-native dashboards and independent portfolio services in 2025.

Are exchange dashboards reliable to use for long-term measurement?

They’re relatively safe because data remains within the exchange itself. They’re not independent, however: if you transfer assets to another platform, holdings go out of sight. For long-term or diversified investors, relying only on one exchange dashboard creates blind spots.

Why would some people choose independent services?

Independent trackers enable you to monitor everything in one place, regardless of storage location. They also offer advanced reporting, including ROI history, tax-ready exports, and risk analysis. The downside is that they require API connections and sometimes paid subscriptions.

Are independent dashboards able to access all large exchanges?

Most top-tier services accommodate dozens of large CEXs and wallets, as well as DeFi and NFT protocols. Although coverage is broad, no solution is perfect — some smaller sites or niche chains still require manual input.

Do institutional platforms make a difference to retail customers?

Not typically. Institutional-grade dashboards such as Talos or Copper provide sophisticated compliance and trading desk functionality that is unnecessary for everyday investors. They can inspire with design and features, but their cost and complexity make them inaccessible for most individuals.

What features make portfolio management easier in 2025?

Several innovations define this year’s trackers:

- Cross-chain aggregation for a unified net worth.

- ROI/PnL accuracy with historical depth.

- Automated tax reporting across jurisdictions.

- Intuitive dashboards that avoid clutter while preserving depth.

Together, these factors decide whether a platform feels streamlined or overwhelming.

Conclusion

The discussion between independent dashboard-exchanges and stand-alone portfolio services has been paramount in 2025. They each have obvious positives, but they appeal to different sorts of clients. The exchange dashboards excel with immediacy and speed of access, offering novices and single-platform holders a low-friction way to see their balance. Independent services, by contrast, answer to the increasing reality of multi-exchange, multi-chain investing.

When assets are held across multiple sites, the limits of built-in tools become clear. Missing DeFi or NFT coverage, absence of tax statements, and exchange bias all diminish their effectiveness. Independent dashboards instead provide neutrality, comprehensive ROI and PnL, and integrations that extend beyond a single exchange. For many active traders, long-term holders, and compliance-focused investors, these strengths outweigh the convenience of built-ins.

The best platforms strike a balance: they minimize blind spots without overwhelming the user, maintain security while enabling automation, and deliver clarity without sacrificing usability. Investors in 2025 no longer accept partial views — they demand confidence that their portfolio reflects the full picture.

Final note: In a crowded market of competing solutions, the platforms that balance independence, precision, and approachable design naturally stand out. They provide the control investors require while keeping daily management practical, making them the most reliable companions in today’s digital asset ecosystem.